Introduction to Cryptocurrency

Cryptocurrency has become a popular term in recent years, but many people still do not fully understand what it is and how it works. In simple terms, cryptocurrency is a digital or virtual currency that uses blockchain technology for secure financial transactions. It operates independently of central banks and is decentralized, meaning there is no single authority controlling it.

Cryptocurrency has gained widespread attention due to its potential to revolutionize the way we handle financial transactions. With the rise of Bitcoin in 2009, the world saw the first successful use of cryptocurrency and since then, numerous other types of cryptocurrencies have emerged. In this blog post, we will take a closer look at what cryptocurrency is, how it works, and its impact on the future of finance.

History of Cryptocurrency

The concept of digital currencies dates back to the 1980s when computer scientist David Chaum proposed the idea of an anonymous electronic money system. However, it was not until the 1990s that various attempts were made to create digital currencies. These early versions of digital currencies, such as Digicash and E-gold, failed due to issues with centralized control and security concerns.

It was not until 2008 that the first successful cryptocurrency, Bitcoin, was created by an unknown person or group using the pseudonym Satoshi Nakamoto. The main idea behind Bitcoin was to create a decentralized digital currency that could be used for peer-to-peer transactions without the need for intermediaries like banks.

Bitcoin’s popularity and success paved the way for the creation of other cryptocurrencies such as Ethereum, Litecoin, Ripple, and more. Today, there are over 6,700 different cryptocurrencies in existence, with a total market capitalization of over $1 trillion.

How Cryptocurrency Works

Cryptocurrencies work through a decentralized network called a blockchain. This is essentially a digital ledger that records all transactions in a transparent and secure manner. Each transaction is verified and added to the blockchain by a network of computers, known as nodes. This eliminates the need for a central authority such as a bank to verify transactions.

In order to use cryptocurrency, users must have a digital wallet, which is essentially a software program that stores their cryptocurrency. Each wallet has a unique public key and a private key. The public key is used to receive funds, while the private key is used to access and send funds from the wallet. It is important to keep the private key safe and secure, as losing it can result in the loss of all the cryptocurrency stored in the wallet.

When a user wants to make a transaction, they broadcast the details of the transaction to the network of nodes. The nodes then verify the authenticity of the transaction and add it to the blockchain. This process usually takes a few minutes, but can sometimes take longer depending on the network’s traffic.

Types of Cryptocurrency

There are various types of cryptocurrencies, each with its own unique features and benefits. Some of the most popular cryptocurrencies include:

- Bitcoin (BTC) – As the first and most well-known cryptocurrency, Bitcoin holds the largest market share of over 60% among all cryptocurrencies. It uses a decentralized system and has a limited supply of 21 million coins.

- Ethereum (ETH) – Unlike Bitcoin, Ethereum is not just a currency but also a platform for building decentralized applications. Its native currency, Ether, is used to pay for transactions and services on the Ethereum network.

- Litecoin (LTC) – Launched in 2011, Litecoin is based on the same technology as Bitcoin but has faster transaction times and lower fees. It is often referred to as the “silver” to Bitcoin’s “gold.”

- Ripple (XRP) – Ripple is a payment protocol and cryptocurrency that aims to facilitate fast and low-cost international payments. It has partnerships with major banks and financial institutions, making it a popular choice for cross-border transactions.

- Tether (USDT) – Unlike most other cryptocurrencies, Tether is a stablecoin, meaning its value is pegged to a stable asset such as the US dollar. This makes it less volatile and more suitable for use as a currency rather than an investment.

Benefits of Using Cryptocurrency

Cryptocurrency offers several benefits over traditional forms of currency, which have contributed to its popularity and adoption. Some of these benefits include:

- Decentralization – As mentioned earlier, cryptocurrency is decentralized, meaning there is no single authority controlling it. This eliminates the need for intermediaries like banks, making transactions faster and cheaper.

- Security – Cryptocurrencies use advanced encryption techniques to secure transactions and prevent fraud. The decentralized nature of the blockchain also makes it difficult for hackers to compromise the system.

- Accessibility – Anyone with an internet connection can access and use cryptocurrency, making it a more inclusive form of currency compared to traditional banking systems.

- Lower Fees – Traditional financial institutions charge high fees for international transactions, but with cryptocurrency, the fees are significantly lower, making it a more cost-effective option.

- Potential for Profits – Cryptocurrency has proven to be a lucrative investment for many people, with some early adopters becoming millionaires. However, it is important to note that investing in cryptocurrency also comes with risks.

Risks and Challenges of Cryptocurrency

While cryptocurrency offers numerous benefits, there are also risks and challenges associated with it. Some of the major ones include:

- Volatility – Cryptocurrencies are highly volatile, with their value constantly fluctuating. This makes it a risky investment and can result in significant losses if not approached carefully.

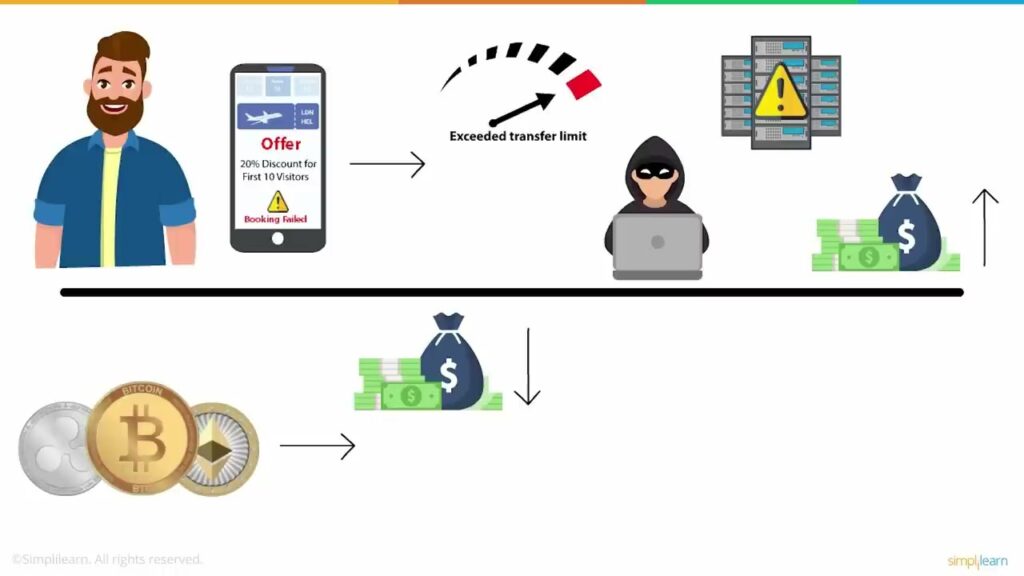

- Lack of Regulation – Cryptocurrencies operate outside of government regulations, making them vulnerable to scams and fraud. There have been numerous cases of cryptocurrency exchanges being hacked, resulting in millions of dollars in losses.

- Complexity – Cryptocurrency is a complex concept, and many people find it difficult to understand how it works. This has resulted in limited adoption among the general public.

- Environmental Impact – The mining process required to create new cryptocurrencies consumes a lot of energy, contributing to environmental concerns.

Future of Cryptocurrency

The future of cryptocurrency is still uncertain, but it is clear that it has the potential to transform the way we handle financial transactions. With increasing adoption and advancements in technology, it is possible that cryptocurrency will become more mainstream in the near future.

Some experts predict that cryptocurrency will eventually replace traditional forms of currency, while others believe it will coexist alongside fiat currencies. One thing is for sure, the use of blockchain technology and digital currencies is here to stay.

Conclusion

In conclusion, cryptocurrency is a revolutionary concept that is changing the way we think about money and finance. It offers numerous benefits such as decentralization, security, and accessibility, but also comes with risks and challenges. As we move towards a more digital world, it is important to educate ourselves about cryptocurrency and its potential impact on our future. Whether it becomes the primary form of currency or not, there is no denying that cryptocurrency has already made its mark on the world of finance.