Are you struggling to pay off your debt? You are not alone. According to a report by the Federal Reserve, the total household debt in the United States reached $13.21 trillion in 2018. This includes mortgage loans, credit card debt, car loans, and student loans. With such high levels of debt, it’s important for individuals to take steps towards reducing their debt in order to achieve financial stability.

The process of reducing debt may seem daunting, but with the right strategies and mindset, it is possible to overcome this challenge. In this blog post, we will discuss the importance of reducing debt, how to create a budget, ways to cut unnecessary expenses, methods to increase income, consolidating debt, seeking professional help, and tips for staying motivated on your journey towards becoming debt-free.

Importance of Reducing Debt

Debt can be both good and bad. Good debt helps you build assets and achieve long-term financial goals, while bad debt can hinder your financial progress and lead to stress and anxiety. As mentioned earlier, the high levels of debt in the U.S. are a cause for concern. Here are some reasons why reducing debt should be a top priority for individuals:

1. Financial Stability

Having large amounts of debt hanging over your head can make it difficult to plan for the future. It can also limit your ability to save for emergencies or retirement. By reducing your debt, you can have more control over your finances and feel more financially stable.

2. Improved Credit Score

Your credit score is affected by your debt-to-income ratio, which is the amount of debt you have compared to your income. A lower debt-to-income ratio can improve your credit score and make it easier for you to access credit with better interest rates in the future.

3. Reduced Stress and Anxiety

Debt can be a major source of stress and anxiety for individuals. Constantly worrying about how to pay off debt can take a toll on your mental health. Reducing your debt can help alleviate this burden and improve your overall well-being.

4. Increased Disposable Income

By reducing your debt, you can free up more of your income for other expenses or savings. This can give you more financial freedom and allow you to achieve your goals faster.

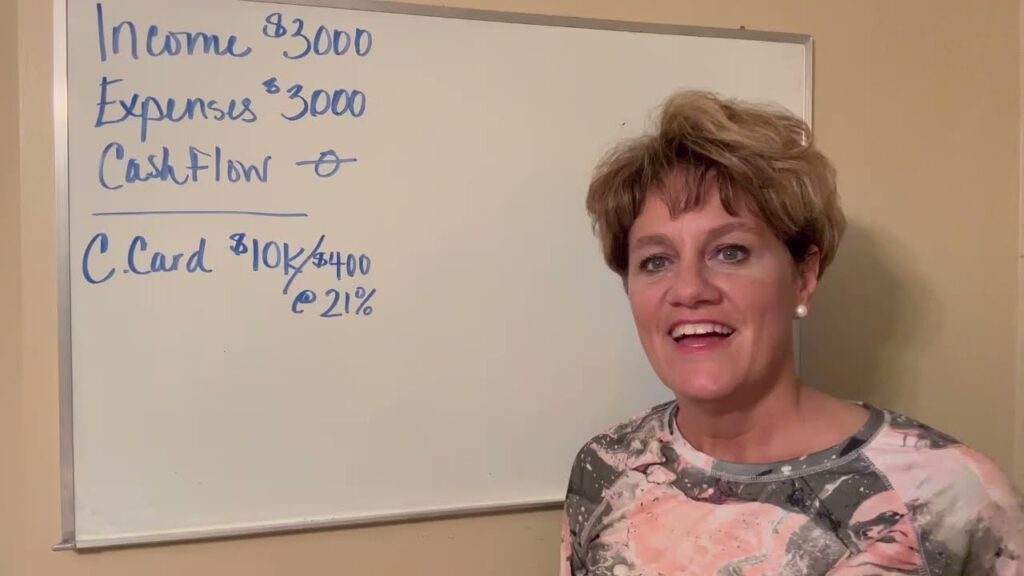

Creating a Budget

One of the first things you should do when trying to reduce your debt is to create a budget. A budget is a plan that outlines your income and expenses, and helps you track where your money is going. Here’s how to create a budget that will help you reduce your debt:

1. Determine Your Income

Start by calculating your monthly income after taxes. This includes your salary, bonuses, freelance earnings, and any other sources of income.

2. List Your Expenses

Make a list of all your monthly expenses, including fixed expenses (rent, mortgage, utilities) and variable expenses (groceries, dining out, entertainment). Be sure to include all your debts as well, such as credit card payments, car loans, and student loans.

3. Identify Non-Essential Expenses

Go through your list of expenses and identify any non-essential items. These are things you can live without or spend less on, such as subscriptions, gym memberships, and daily coffee runs.

4. Set a Realistic Budget

Based on your income and expenses, set a realistic budget that allows you to cover your essential expenses while still leaving room for debt repayment. Make sure to include a category for savings in your budget, even if it’s a small amount.

5. Stick to Your Budget

Creating a budget is not enough; you need to stick to it. Be disciplined and avoid overspending. Use budgeting apps or spreadsheets to track your expenses and stay on top of your budget.

Cutting Unnecessary Expenses

As mentioned earlier, identifying and cutting unnecessary expenses is crucial in reducing debt. Here are some tips to help you cut back on your spending:

1. Cut Back on Eating Out

Eating out can be expensive, especially if you do it often. Instead of dining out, try cooking at home more often. Not only is it cheaper, but it’s also a healthier option.

2. Cancel Subscriptions You Don’t Use

Are you paying for subscriptions that you rarely use? It’s time to cancel them. This could include gym memberships, streaming services, or magazine subscriptions. If you still want access to these services, consider sharing accounts with family or friends to save money.

3. Use Coupons and Discounts

Be on the lookout for discounts and coupons when shopping for groceries or other items. Many stores offer loyalty programs or digital coupons that can save you money on your purchases.

4. Reduce Utility Bills

Reduce your utility bills by being mindful of your energy usage. Turn off lights and electronics when not in use, and consider switching to energy-efficient appliances. You can also reduce water consumption by fixing any leaks and taking shorter showers.

5. Shop Smartly

When making big purchases, take the time to compare prices between different retailers. You can also purchase used items instead of new ones, or wait for sales and deals.

Increasing Income

While reducing expenses is important, increasing your income can also help you pay off your debt faster. Here are some ways to boost your income:

1. Negotiate a Raise

If you have been at your job for a while and have been performing well, it might be time to ask for a raise. Be prepared and make a case for why you deserve a raise. This may include highlighting your achievements and contributions to the company.

2. Get a Side Hustle

Having a side hustle is a great way to supplement your income and help you pay off your debt faster. This could include freelancing, pet-sitting, or selling items online.

3. Rent Out a Room

If you have an extra room in your house, consider renting it out to bring in some extra cash. You could also list your space on platforms like Airbnb for short-term rentals.

4. Take Up a Part-Time Job

Taking up a part-time job can be a great way to increase your income. It could also provide you with new skills and experiences that could lead to better opportunities in the future.

Consolidating Debt

Consolidating your debt involves combining multiple debts into one loan with a lower interest rate and lower monthly payments. Here’s how it works:

1. Understand Your Options

There are different options for consolidating debt, such as balance transfer credit cards, personal loans, and home equity loans. Make sure you understand the terms and conditions of each option before making a decision.

2. Compare Interest Rates and Fees

When considering consolidation loans, compare interest rates and fees from different lenders. Look for a loan with a lower interest rate and minimal fees to save money in the long run.

3. Beware of Scams

Be cautious of debt consolidation scams that promise to eliminate your debt quickly. Do your research and make sure you are working with a reputable lender.

4. Stop Using Credit Cards

Consolidating debt will not help if you continue to use your credit cards and accumulate more debt. Cut up your credit cards or keep them locked away until you have paid off your consolidated loan.

Seeking Professional Help

Sometimes reducing debt may require more than just budgeting and cutting expenses. If you feel overwhelmed by your debt, seeking professional help can be a good option. Here are some professionals who can assist you:

1. Credit Counselors

Credit counselors work with individuals to create a personalized debt management plan. They can also provide financial education and budgeting advice.

2. Financial Coaches

Similar to credit counselors, financial coaches can help you develop a plan to reduce your debt. They can also offer guidance on financial decisions and help you stay accountable.

3. Bankruptcy Attorneys

If you are considering bankruptcy as an option, it’s important to consult a bankruptcy attorney to understand the process and implications. They can also advise you on whether or not filing for bankruptcy is the best solution for your situation.

Tips for Staying Motivated

Reducing debt is a long-term process that requires patience, determination, and motivation. Here are some tips to keep you motivated on your journey towards becoming debt-free:

1. Set Realistic Goals

Set achievable goals for yourself. This could include paying off a certain amount of debt each month or increasing your income by a certain percentage. Celebrate your achievements along the way to stay motivated.

2. Create a Vision Board

Visualizing your goal can be a powerful motivator. Create a vision board with pictures and quotes that represent your goal of reducing debt. Place it somewhere you can see it every day.

3. Find an Accountability Partner

Find someone who can hold you accountable and motivate you when you feel like giving up. This could be a friend or family member who is also trying to reduce their debt or a professional coach.

4. Reward Yourself

When you reach a milestone in your debt reduction journey, treat yourself to something small. This could be a nice dinner out or a day trip. Just make sure it doesn’t put you back into debt.

5. Stay Positive

Finally, stay positive and don’t get discouraged if progress seems slow. Remember that reducing debt takes time and effort, but the end result will be worth it.

Conclusion

Reducing debt is not an easy task, but with determination and the right strategies, it is possible to become debt-free. Create a budget, cut unnecessary expenses, look for ways to increase income, consolidate debt if necessary, and seek professional help if needed. Stay motivated and celebrate your achievements along the way. Remember, becoming debt-free will not only improve your financial situation, but also your overall well-being.