When it comes to taking out a loan, one of the most important factors to consider is the interest rate. Interest rates have a direct impact on the cost of borrowing money and can significantly influence the overall amount you will end up paying for your loan. In this blog post, we will explore the relationship between interest rates and loans and how changes in interest rates can affect different types of loans. We will also look at how various factors can influence interest rates and provide real-life examples to help understand the impact of interest rates on loans.

Introduction

Before diving into the impact of interest rates on loans, let’s first understand what interest rates are. In simple terms, an interest rate is the amount charged by a lender for borrowing money. It is expressed as a percentage of the original loan amount and is typically calculated annually. Interest rates play a crucial role in the economy as they not only determine the cost of borrowing but also impact savings, investments, and overall economic growth.

Interest rates can be either fixed or variable. Fixed interest rates remain the same throughout the loan term, while variable interest rates can fluctuate based on market conditions. Now, let’s move on to explore the different types of loans that are affected by interest rates.

Explanation of Interest Rates

Interest rates are determined by various factors, including inflation, supply and demand for credit, government policies, and the overall state of the economy. When the demand for credit is high, lenders can charge a higher interest rate as borrowers are willing to pay more to secure a loan. On the other hand, when the demand for credit is low, lenders may offer lower interest rates to attract more borrowers.

The Federal Reserve plays a significant role in setting interest rates in the United States. The Federal Open Market Committee (FOMC) meets regularly to discuss and adjust the federal funds rate, which is the interest rate at which banks can borrow money from each other. Changes in the federal funds rate can have a ripple effect on other interest rates, ultimately impacting the cost of borrowing for consumers.

Types of Loans Affected by Interest Rates

Interest rates can affect various types of loans, including mortgages, personal loans, auto loans, and credit cards. Here’s a closer look at how interest rates impact these different loan types.

Mortgages

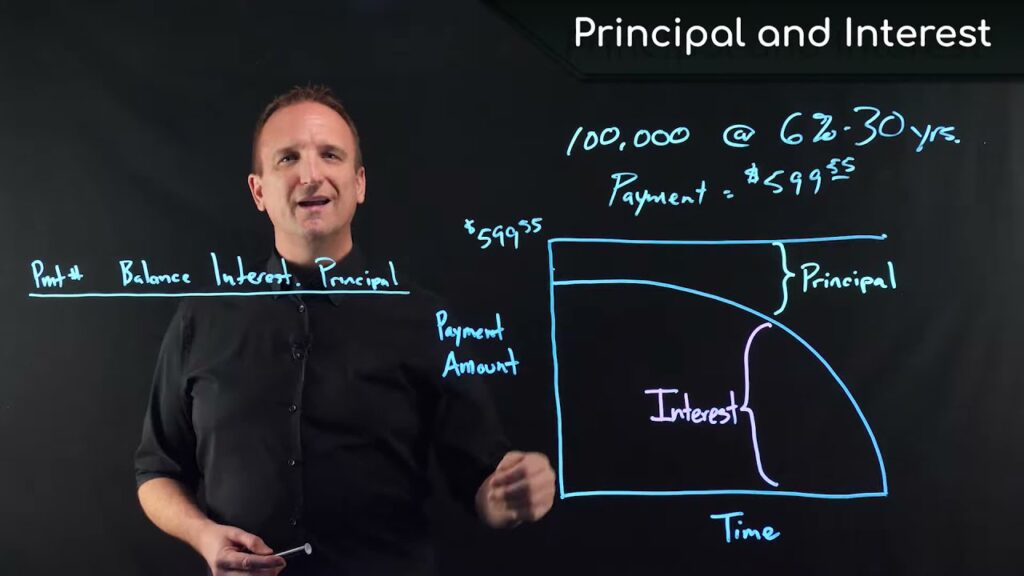

When it comes to purchasing a home, most people rely on a mortgage to finance the purchase. Mortgages typically have long repayment periods, ranging from 15 to 30 years, making them highly sensitive to changes in interest rates. A small change in interest rates can significantly impact the monthly payments and the total amount paid over the loan term.

For example, let’s say you take out a $300,000 mortgage with a 3.5% interest rate for 30 years. Your monthly payment would be $1,347, and you would end up paying a total of $485,220 over the loan term. However, if the interest rate increases to 4%, your monthly payment would increase to $1,432, and you would end up paying a total of $515,520 over the loan term. That’s an additional $30,300 in interest just from a 0.5% increase in interest rates.

Personal Loans

Personal loans are another type of loan that can be impacted by interest rates. These loans are usually unsecured, meaning they do not require collateral, and have fixed interest rates. The interest rate on a personal loan is determined based on the borrower’s credit score, income, and debt-to-income ratio. If interest rates rise, borrowers may see an increase in their monthly payments, making it more challenging to repay the loan.

Auto Loans

Auto loans are used to finance the purchase of a vehicle and are either secured or unsecured. A secured auto loan means the vehicle serves as collateral, while an unsecured auto loan does not require any collateral. Similar to personal loans, the interest rate on an auto loan is influenced by factors such as credit score and income. If interest rates go up, borrowers may see an increase in their monthly payments, making it more expensive to purchase a vehicle.

Credit Cards

Credit cards also have variable interest rates, meaning they can change based on market conditions. The interest rate on credit cards is typically tied to the prime rate, which is the interest rate that banks offer to their most creditworthy customers. When the prime rate increases, credit card interest rates also tend to rise, making it more expensive for consumers to carry a balance on their cards.

Factors Influencing Interest Rates

As mentioned earlier, several factors can influence interest rates. Let’s take a closer look at some of the key factors that impact interest rates and how they can affect the cost of borrowing.

Inflation

Inflation is the general increase in prices over time. When inflation rises, the purchasing power of money decreases, meaning you can buy fewer goods with the same amount of money. To combat inflation, the government may raise interest rates to encourage people to save instead of spending, ultimately reducing the demand for goods and services.

Conversely, when inflation is low, the government may lower interest rates to stimulate economic growth by encouraging people to spend money. This is because low-interest rates make borrowing money more affordable, leading to increased consumer spending, which can boost economic activity.

Economic Growth

The state of the economy plays a crucial role in influencing interest rates. When the economy is growing, and there is high demand for goods and services, lenders may increase interest rates to slow down economic growth. On the other hand, during a recession, when the economy is struggling, the government may lower interest rates to stimulate economic activity.

Government Policies

Government policies, such as monetary and fiscal policies, can also impact interest rates. Monetary policy is determined by the Federal Reserve and involves controlling the money supply in the economy through actions like adjusting interest rates.

Fiscal policy, on the other hand, is set by the government and involves making changes to tax rates and government spending. For instance, if the government increases spending, they may need to borrow money, causing a rise in interest rates.

Global Economic Events

Global economic events, such as political instability or changes in international trade agreements, can also impact interest rates. These events can create uncertainty in financial markets, causing investors to move their money to safer investments, resulting in higher interest rates.

The Impact of Interest Rates on Loan Payments

Now that we have discussed the types of loans affected by interest rates and the factors that influence them let’s explore the direct impact of interest rates on loan payments. As mentioned earlier, even small changes in interest rates can have a significant impact on the cost of borrowing.

To understand this better, let’s look at a case study. John is looking to purchase a home and needs a $200,000 mortgage. He has been offered two options, a 4% fixed interest rate and a 3.5% variable interest rate, both with a repayment period of 30 years.

| Loan Type | Interest Rate | Monthly Payment | Total Amount Paid |

|---|---|---|---|

| Fixed | 4% | $954 | $343,440 |

| Variable | 3.5% | $898 | $323,280 |

As seen in the table above, opting for the variable interest rate would result in a lower monthly payment. However, if interest rates increase by just 0.5%, his monthly payment would increase to $1,002, resulting in paying an additional $48 per month and $17,280 over the loan term. This highlights the importance of considering interest rates when taking out a loan.

Real-Life Examples

To further understand the impact of interest rates on loans, let’s look at some real-life examples.

Impact of Decreasing Interest Rates

In 2012, the Federal Reserve lowered interest rates to near-zero levels to stimulate economic growth after the Great Recession. As a result, mortgage interest rates also dropped significantly, making it more affordable for homeowners to refinance their mortgages.

According to data from Freddie Mac, the average 30-year fixed mortgage rate was 3.66% in 2012. By 2020, this had dropped to an all-time low of 2.65%. This decrease in interest rates resulted in significant savings for homeowners who were able to refinance their mortgages at lower rates.

Impact of Increasing Interest Rates

On the other hand, in 1981, mortgage interest rates hit an all-time high of 18.63%. This was due to high inflation and the Federal Reserve increasing interest rates to combat it. The high-interest rates made it challenging for people to afford homes, resulting in a slowdown in the housing market.

Additionally, higher interest rates can also make it more expensive for businesses to borrow money, potentially reducing their ability to invest and grow. This can have a ripple effect on the economy as a whole, leading to slower economic growth.

Conclusion

In conclusion, interest rates play a vital role in the cost of borrowing money and can have a significant impact on various types of loans. Changes in interest rates can affect monthly loan payments, the total amount paid, and overall economic growth. It is essential to carefully consider interest rates when taking out a loan to ensure you are getting the best deal and can comfortably repay the loan. Understanding the factors that influence interest rates can also help individuals and businesses make informed decisions when it comes to borrowing money.