In recent years, the investment world has seen a surge in popularity and growth of Exchange-Traded Funds (ETFs). These innovative financial instruments have revolutionized the way investors approach their portfolios, providing a diverse range of benefits and opportunities. With over $5 trillion in global assets as of 2021, ETFs have firmly established themselves as a […]

Tag Archives: finance and business

Tax planning is an essential aspect of financial management that often gets overlooked or underestimated. Many individuals and businesses tend to view tax planning as a tedious chore, rather than a strategic approach towards maximizing wealth and minimizing tax liabilities. However, when done correctly, tax planning can have a significant impact on your financial well-being. […]

As a business owner, you face numerous uncertainties and risks every day. From natural disasters to lawsuits, the unexpected can happen at any moment, threatening your financial stability and the success of your enterprise. This is where business insurance becomes crucial. It acts as a safety net, providing protection against potential risks and ensuring that […]

Freelancing has become an increasingly popular career choice for many individuals, offering flexibility, independence, and the opportunity to work on diverse projects. However, as a freelancer, you are also responsible for managing your own finances. This can be a daunting task for those who are used to having a steady paycheck from a traditional job. […]

Corporate finance is a fundamental aspect of any business. It encompasses all financial decisions and strategies that a company makes, from securing capital to making investments. In today’s highly competitive business landscape, a strong understanding of corporate finance principles is crucial for success. This comprehensive guide aims to provide readers with a deeper understanding of […]

Introduction Your credit score, that mysterious three-digit number, holds significant power over your financial life. It influences everything from your ability to secure loans and mortgages at competitive rates to obtaining credit cards with enticing rewards. A good credit score unlocks doors to financial opportunities, while a poor one can limit your options and even […]

Real estate investment is a popular form of investment that involves the purchase, ownership, management, rental, and/or sale of real estate for profit. This type of investment has been around for centuries and is considered one of the safest and most lucrative forms of investment. In recent years, real estate investment has gained even more […]

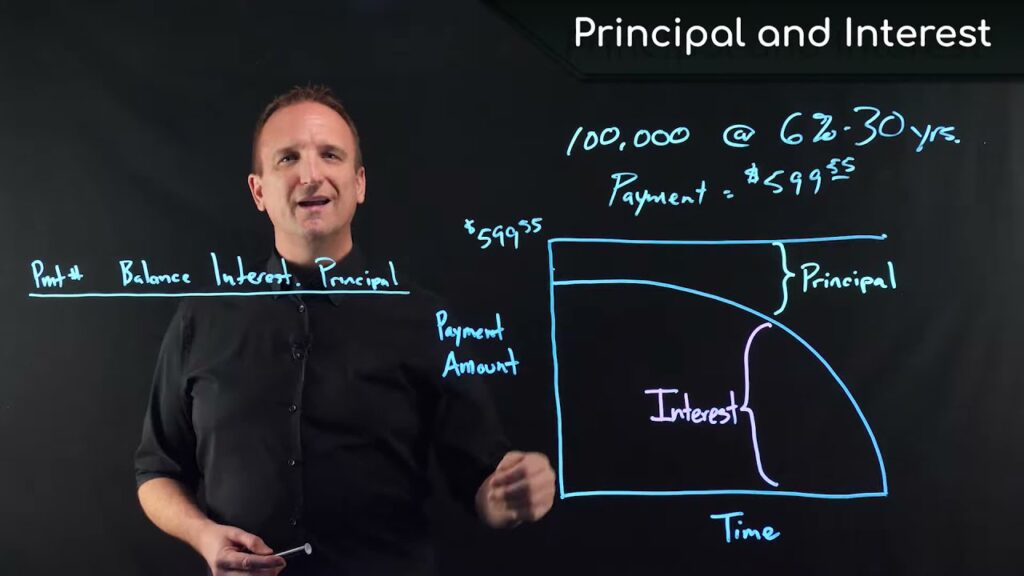

When it comes to taking out a loan, one of the most important factors to consider is the interest rate. Interest rates have a direct impact on the cost of borrowing money and can significantly influence the overall amount you will end up paying for your loan. In this blog post, we will explore the […]

Investing is a crucial aspect of financial planning, and building a successful investment portfolio can pave the way towards achieving your financial goals. However, it can be overwhelming and intimidating for beginners to navigate the world of investments, with so many options and strategies available. In this blog post, we will guide you through the […]

In recent years, the term “cryptocurrency” has become increasingly popular in the financial world. It has been a topic of interest for investors, traders, and even the general public. But what exactly is cryptocurrency? How does it work? What are the benefits and risks associated with it? In this blog post, we will delve into […]

As we navigate through life, one thing is certain – the need for financial stability and security. Whether it’s planning for retirement, buying a dream home, or saving up for your children’s education, managing finances can be a daunting task. This is where the services of a financial advisor come into play. Financial advisors are […]

As a small business owner, managing your finances is an essential aspect of running a successful and sustainable company. It can be overwhelming to handle all the financial aspects of your business, especially if you do not have a background in finance. However, with proper planning and organization, it is possible to manage your small […]

Introduction The stock market is a term that is often heard in the news, on social media, and in conversations among friends. It can be a source of fascination for some, while others may find it confusing and intimidating. However, understanding the basics of the stock market can be beneficial for everyone, regardless of their […]

In life, unexpected events and expenses can arise at any given moment. Whether it’s a sudden job loss, a medical emergency, or unexpected home repairs, having enough money saved up can make all the difference. This is where an emergency fund comes in. An emergency fund is a financial safety net that provides you with […]

Are you struggling to pay off your debt? You are not alone. According to a report by the Federal Reserve, the total household debt in the United States reached $13.21 trillion in 2018. This includes mortgage loans, credit card debt, car loans, and student loans. With such high levels of debt, it’s important for individuals […]

When it comes to investing, there are many options available in the market. One such option that has gained popularity over the years is mutual funds. A mutual fund is a type of investment where money from multiple investors is pooled together to purchase a diversified portfolio of stocks, bonds, and other securities. This allows […]

Introduction: Retirement is a topic that may seem far off for some, but it is never too early to start planning and saving for it. With the increasing life expectancy and rising costs of living, it is essential to have a solid retirement savings plan in place. Many people find themselves unprepared for retirement, leading […]

Investing is a crucial aspect of personal finance and wealth building. It involves putting your money into different assets with the expectation of generating a return in the future. The goal of investing is to grow your wealth over time, whether it is for short-term goals like buying a car or long-term goals like retirement. […]

Credit scores are an important aspect of personal finance that many people may not fully understand. Your credit score is a numerical representation of your overall creditworthiness, and it plays a significant role in determining your financial health. It can affect your ability to get approved for loans, credit cards, or even rent an apartment. […]

Personal budgeting is an essential tool for managing finances and achieving financial stability. It involves creating a plan to track income and expenses, setting financial goals, and making informed decisions on spending and saving. Despite its importance, many people struggle with creating and sticking to a budget. However, with the right strategies and mindset, personal […]